Insights

As we move forward into 2021, many people are pleased to be saying goodbye to 2020 and hoping for a better year ahead. As such here are our top five HR themes to watch out for to ensure compliance, and hopefully an easier 2021, for employers and employees.

1. Plan for changes to the Coronavirus Job Retention Scheme

It came as a surprise to many people when the government announced at very short notice that the CJRS (Furlough) scheme was to be extended from October 2020 until 30 April 2021. Currently, there has been no update on this extension, so employers should prepare for furlough coming to an end on that date.

We do know that the scheme will cover 80% of furloughed employees’ wages (capped at £2,500 per month) until 31 January 2021. The government will review the terms of the scheme in January and decide if employers should be required to contribute a proportion of employees’ wages from 1 February to 30 April 2021.

When the review is published, employers will need to assess how any changes to the scheme will impact their business and plan how to respond when the scheme comes to an end.

We will communicate the announcement when it is available.

2. Be ready for the new immigration system

Brexit is in our number 2 place, hopefully employers are already aware that the end of the Brexit transition period means that there will be a new points-based immigration system in place from 1 January 2021.

As from the 1 January 2021 EEA nationals arriving in the will be required to comply with the same visa requirements as other non-UK nationals.

As such, employers need to understand how the new system will affect their recruitment and onboarding processes. They should also consider whether they will need to apply for a sponsor licence.

If an employer hasn’t already done so, they should be encouraging existing EEA employees to apply for settled or pre-settled status. To ensure inclusivity, we suggest you may wish to consider writing to all your employees regarding this requirement.

European nationals already in the UK before the end of the transition period have a grace period until 30 June 2021 to apply under the settlement scheme. Employers will need to understand the rules on right to work checks during this period.

3. National Minimum Wage & Statutory Payments

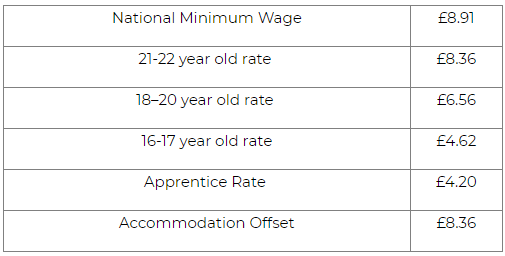

With effect from the 1 April 2021 the National Living and Minimum Wage increase to the following rates;

In addition to the increase in the hourly rate, the age from which employees are entitled to the statutory national minimum wage is due to reduce from 25 to 23 from 1 April 2021. although it is possible that this could be postponed due to the coronavirus pandemic, but we advise to be prepared and budget for this increase as of the 1 April 2021.

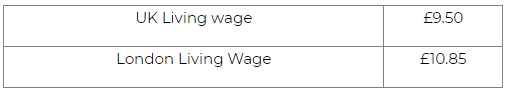

For those employers who play the Real Living Wage, an increase was announced on the 9th November 2020, and employers should implement the rise as soon as possible and within 6 months. Therefore, all employees should be receiving the new 2020/21 rates by 9th May 2020. The new rates are as follows:

Statutory rates of pay usually change every April and there is no reason to think 2021 will be any different.

The current weekly rate of statutory maternity pay is £151.20, or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate.

This and other statutory payments will increase to £151.97 from 4th April 2021.

This includes the first annual increase for statutory parental bereavement pay, statutory paternity pay, statutory shared parental and statutory adoption pay.

The rate of statutory sick pay is also expected to increase from £95.85 to £96.35 on 6 April 2021.

4. Review Contracts for IR35

The date for changes to the IR35 rules on off-payroll working in the private sector was delayed due to the coronavirus pandemic, with the new date being the 6 April 2021. The rules are aimed at reducing tax avoidance for contractors employed via personal service companies.

Under the new rules, the organisation engaging the contractor is responsible for determining their employment status and assessing whether IR35 applies. If it is deemed after assessment that IR35 does apply, it is the organisation that pays the individual’s fees who is deemed to be their employer for tax and national insurance purposes.

Employers should therefore be giving some careful thought as to how they will actually determine employment status. To make sure you’re doing the right thing, please get advice from a HR professional.

5. Redundancy protection for pregnant employees and new parents may be extended.

The government consulted in 2019 on extending redundancy protection, i.e. the right to be offered suitable alternative employment, for employees taking maternity leave and for other new parents.

The current protection only applies to those on maternity leave, however the government has committed to extending the period of protection, so that it would apply from the point the employee informs their employer that they are pregnant and continue for six months after their return to work.

There would also be extensions to the protection periods for employees taking adoption leave and shared parental leave.

An Employment Bill was announced in the December 2019 Queen’s Speech, to include measures to extend redundancy protection to prevent pregnancy and maternity discrimination. No date has yet been set for these changes to be brought into force, but it is expected in 2021.

If you need any further advice or guidance based on the matters raised above the Alcumus PSM HR Consultancy are on hand to help. Simply email [email protected] or call us on 01484 439930.

Alcumus PSM (People & Safety Management) specialises in human resources (HR) and health and safety (H&S) consulting for small and medium-sized enterprises.

Written by Susan Barker, Senior HR Consultant