Insights

We know that April tends to be a busy time in the employment law field.

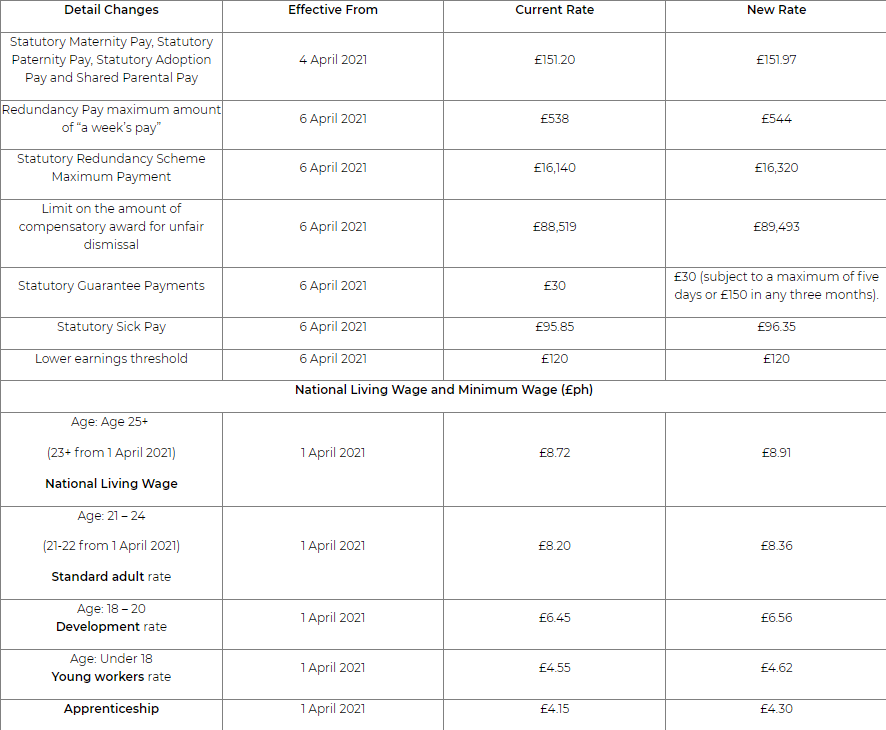

To support you through this time we've put together the key changes to statutory payments, which are currently known and effective from April 2021.

Please find below a summary of the key changes which are effective from April 2021.

Other changes

National living wage (NLW)

This rate was introduced on 1 April 2016 and applied to workers aged 25 and over at that time. With effect from 1 April 2021 it will be extended to 23 and 24-year olds. The standard adult rate will then apply to those aged 21 to 22.

The NLW should not be confused with the Living Wage (sometimes called the "real Living Wage") set by the Living Wage Foundation, a campaigning organisation which promotes a voluntary minimum hourly rate of pay calculated according to the basic cost of living.

In addition to the above, we want to take this opportunity to remind you of another employment legislation change which will become effective in April 2020.

IR35

Changes to the off-payroll tax legislation, IR35, due to be implemented in April 2020 but deferred, will come into effect from 6 April 2021 and are intended to counter non-compliance with IR35.

The measure shifts the compliance burden from the worker's personal service company to the medium and large "client" organisations that they work for, by treating the client organisation as an employer for income tax and NICs purposes.

Previously, it was up to contractors to determine if they fell inside IR35 rules but in 2017, the responsibility in the public sector at that time shifted to the organisation. The rules have now been extended to the private sector and the burden of deciding whether a worker is IR35-compliant or not will be down to the organisation contracting the work, rather than the worker themselves.

Genuinely self-employed contractors are still treated as outside IR35 but if the contractor is deemed to be working “inside IR35” for an assignment (i.e. deemed to be an employee for tax purposes) then the employer will have a statutory duty to ensure that tax & national insurance (both employers and employees) plus apprenticeship levy are applied to their payments which will, of course, affect the cost of those contractors.

The Check Employment Status Tax tool (CEST) is already available for organisations and contractors to consider the appropriate employment status for tax for contracts running beyond 6 April 2021.

Contact the Alcumus PSM HR team for more information and/or advice on any of the above or by emailing [email protected] or call us on 01484 439930.

Alcumus PSM (People & Safety Management) specialises in human resources (HR) and health and safety (H&S) consulting for small and medium-sized enterprises.

Written by Sally Grundy, Senior HR Consultant