National living and minimum wage to increase from April 2022

The national living wage paid to workers aged 23 and over will rise from £8.91 per hour to £9.50 per hour from 1 April 2022, the Government announced. This represents an increase of 59 pence per hour and an extra £1,000 per year if you work full-time. The national minimum wage for workers aged under 23 and apprentices will also rise.

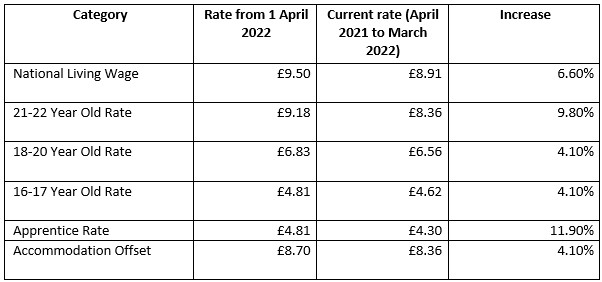

Here's how national living and minimum wage rates will change from 1 April 2022:

National living wage is different to the 'real living wage'

Introduced in July 2015 by the then Chancellor George Osborne, the compulsory national living wage is the lowest amount that can legally be paid to employees aged 23 or over. It is adjusted every April. The age at which workers become eligible for the national living wage was reduced in April this year, from 25 to 23, and is currently higher than the compulsory minimum wage, which is for those aged 22 and under.

The national living wage is different from the real living wage though, which is the amount calculated by campaign group the Living Wage Foundation as the minimum pay workers and their families need to live. The real living wage is currently £9.50 per hour across the UK and £10.85 per hour in London, for anyone aged over 18.

The new real living wage rates were announced on 15 November 2021. Under the changes, workers whose employers pay the real living wage will now earn the following rates, although employers have up to six months to implement the changes:

- Across the UK other than London – the real living wage rate has risen by 40 pence per hour - from £9.50 per hour to £9.90 per hour.

- In London, the real living wage has risen by 20 pence per hour- from £10.85 per hour to £11.05 per hour.

The real living wage is voluntarily paid by almost 9,000 UK employers and it’s estimated more than 300,000 workers will receive a pay rise as a result of the increase.

Considerations for employers

The significant increase from April 2022 will mean that national minimum wage (NMW) legislation becomes relevant to far more employees. Employers need to consider it won't just be limited to hourly paid employees, as the higher rates increasingly bring salaried employees close to the minimum particularly once the increase takes effect, the minimum annual salary for a worker aged over 23 on a 40-hour week for example will be just under £20,000 per annum.

Where an employee's higher rate of pay is more than the new minimum, employers will need to review the position carefully due to the complexity of the NMW calculation. This is particularly relevant where employers operate salary sacrifice schemes, such as for pension contributions. Employees must not be allowed to sacrifice their pay to below the NMW, and employers should ensure that their payroll systems have measures in place to prevent this from happening.

It also advisable that employers ensure that their systems flag when an employee is approaching their 23rd birthday, so that they can check whether that employee’s pay needs to be increased to meet the national minimum wage requirements.

If you would like to know more about how Alcumus PSM HR consultancy can support your business with changes to the national minimum and living wage from April 2022 please speak with your HR Consultant or contact us at [email protected] or call 01484 439930.

James Day, HR Consultant – November 2021